Making Tax Digital

for VAT

Everything you need to submit your VAT returns online

Simple, fast and HMRC recognised.

As from 1st April 2022 ALL VAT-registered businesses are required to:

- Keep their records digitally (for VAT purposes only), and

- Provide their VAT return information to HM Revenue and Customs (HMRC) through Making Tax Digital (MTD) functional compatible software

ALL VAT-registered businesses must follow the MTD for VAT rules from the first day of the first VAT period that starts on or after 1st April 2022. HMRC has issued guidance to help you.

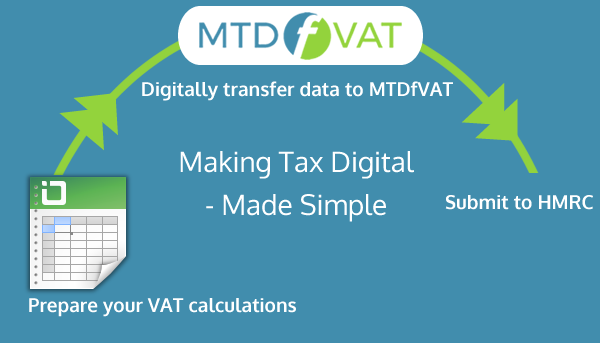

MTDfVAT is a simple, secure and affordable cloud-based solution to help you meet the MTD for VAT filing requirements.

Who is MTDf VAT for?

If you are UK VAT registered, you MUST comply with the new HMRC requirement of Making Tax Digital.

We have two versions of MTDfVAT: ‘Company’ for Limited companies, Partnerships and Limited Liability Partnerships and ‘Individual’, for Sole Traders.

Simply choose your version on our purchasing page. After purchase you will be sent all the details you need to get started, including your VAT receipt, full instructions, and your secure login details to our online submissions hub.

Making Tax Digital for Value Added Tax

MTDfVAT is a VAT filing solution that provides an easy to use and secure system for submitting your VAT returns electronically in an MTD compatible format.

You don’t need to be a techie, nor will it break the bank.

MTDfVAT is a cloud-based Software as a Service (SaaS) product, and provides the following features and benefits:

Be Prepared for the full inclusion of all VAT registered businesses.

MTDfVAT – flexible and user-friendly MTD for VAT bridging software for your business or organisation.

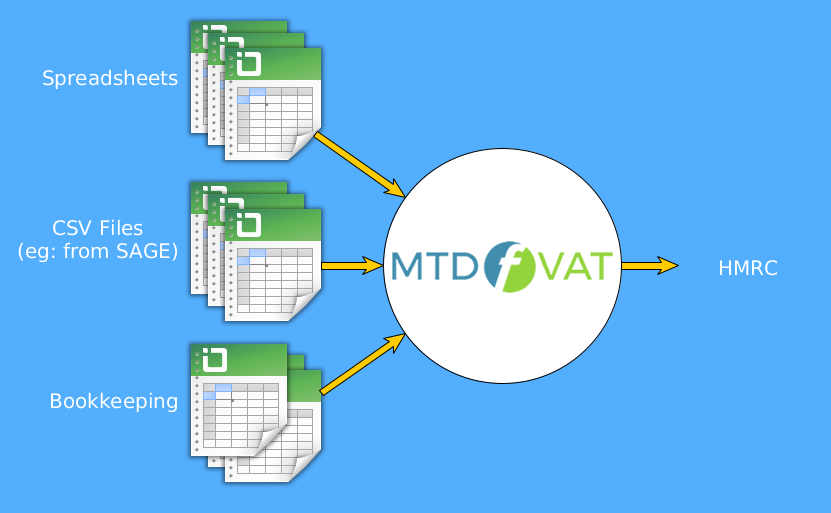

MTDfVAT software is a cloud-based, Software as a Service (SAAS) product. It gives handy MTD for VAT bridging software functionality to enable compliance, but also without disruption to your existing accounting system and processes.

Control Centre has the following features:

- Management Dashboard

- Control of submissions for Companies or Individuals

- Vat report centre

- Dashboard view of your obligations

- Validates and submits VAT data in an MTD-compatible format to HMRC at the touch of a button

- Gives a window view of your MTD VAT payments and refund history

- Has Excel spreadsheet-friendly functionality – irrespective of how those are set up be it a single tab or multiple workbooks. The software draws the data in digitally From the spreadsheet into an MTD for VAT compatible format for submission to HMRC with validation checking

- It will accept CSV imports from Sage and other bookkeeping packages and we are happy to test your output file to show you how it works.